Alabama Income Tax Calculator for 2023-2024

Calculate Your Take-Home Pay and Estimated Taxes

How Much Will You Pay in Alabama Taxes?

Are you curious about how much of your hard-earned income goes towards Alabama state taxes? Our Alabama income tax calculator provides a quick and easy way to estimate your tax liability and take-home pay. Whether you're a salaried employee or self-employed, our calculator can help you plan your finances and understand your tax obligations.

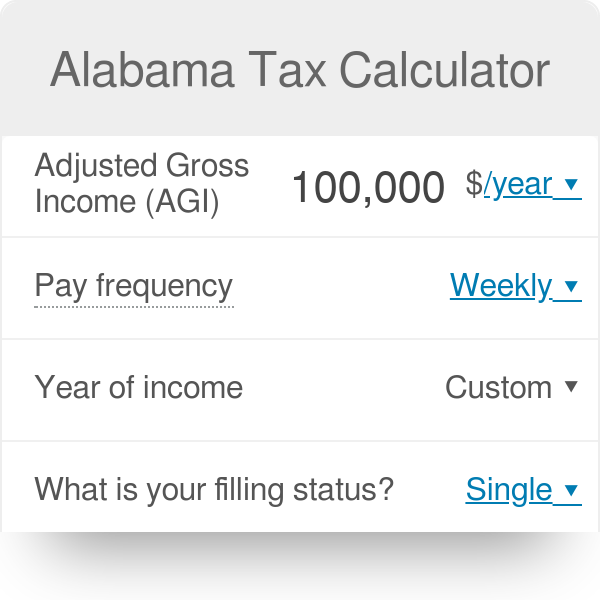

To use the calculator, simply enter your annual income, including wages, salaries, self-employment income, and any other taxable income. The calculator will automatically adjust your gross income based on applicable deductions and exemptions to determine your adjusted gross income (AGI). It will then apply the Alabama state income tax rates to your AGI to calculate your estimated tax liability.

In addition to estimating your state taxes, the Alabama income tax calculator also provides a breakdown of your estimated federal income taxes and other deductions. This comprehensive view allows you to see how your income is distributed and how much you can expect to receive as a net paycheck after taxes and other withholding.

Please note that the Alabama income tax calculator provides an approximation of your tax liability. The actual amount of taxes you owe may vary based on factors such as your filing status, dependents, and itemized deductions or credits. For a more accurate tax estimate, it is recommended to consult with a tax professional.

Comments